How to earn yield on bitcoin using DeFi

BasedXeno

6 months ago ·

11 min read

While the price of Bitcoin has increased sixfold within the past 12 months, and institutional buyers are entering at a steadily increasing pace, it can feel a little, well, boring to sit and watch while the Ethereum ecosystem vibrates with exotic software oddities transforming traditional financial primitives into new and improved forms. This revolution is DeFi.

While merely owning Bitcoin already puts you among a select group of people at the bleeding edge of financial technology, there is always the tantalizing prospect of earning interest on it as an income-generating asset. There's a strong case to be made that Bitcoin is the "soundest money" ever created, and the best collateral the world has ever seen. So how can we put it to work? While there are "safe" ways to do this via centralized crypto exchanges, the real magic is happening right now in the Wild West of yield farms & lending protocols, and so far the bulk of the action is taking place on Ethereum, far away from the tiny, simple blocks of the Bitcoin network.

Not to worry! In order to participate in the DeFI revolution that is currently underway in the Ethereum ecosystem, Bitcoin owners actually have several choices at their fingertips. First, we'll provide a brief overview of those choices, and then go into more detail about the various opportunities available. You can also be confident that you're not alone in wanting to be able to participate in the DeFi ecosystem - the number of Bitcoins represented on the Ethereum network have increased at an exponential pace, with over 170,000 Bitcoin now wrapped in some form.

To begin with, the most important point to understand is: if you want to utilize the value of your Bitcoin within DeFi, for earning yield, taking out loans, or speculating, you'll need to have your Bitcoin "wrapped" so that it can be represented within the Ethereum network as a native token that can interoperate with other Ethereum-based services. The primary tokens that you'll use for this purpose are WBTC, HBTC and renBTC (there are others but these are the dominant options), and once you have one of those tokens you can put on a snazzy beret, load up your MetaMask, stick a crusty baguette into your Sushiswap tote and enter the infamous "Future of France".

To begin with, the most important point to understand is: if you want to utilize the value of your Bitcoin within DeFi, for earning yield, taking out loans, or speculating, you'll need to have your Bitcoin "wrapped" so that it can be represented within the Ethereum network as a native token that can interoperate with other Ethereum-based services. The primary tokens that you'll use for this purpose are WBTC, HBTC and renBTC (there are others but these are the dominant options), and once you have one of those tokens you can put on a snazzy beret, load up your MetaMask, stick a crusty baguette into your Sushiswap tote and enter the infamous "Future of France".

Why does Bitcoin need to be wrapped on Ethereum?

Let's quickly cover why Bitcoin needs to be "wrapped" in the first place. Each blockchain, such as Bitcoin, Ethereum or Polkadot are unique protocols - much like TCP or HTTP - and as such require a specific structure of communication. At their core, they simply don't speak the same language. The problem of how to get these different blockchains to be able to communicate with each other efficiently is an ongoing challenge with multiple solutions currently being trialled but, as it stands currently, we can't just plug a Bitcoin into another network - it needs to be transformed into code that the other network can understand.

To get Bitcoin onto the Ethereum network we need a native ERC-20 token that represents Bitcoin. Of course, this leads to another issue - how can an Ethereum token represent actual Bitcoin? How can it maintain a pegged value? How do we get our Bitcoin back when we're done? The answer is that the underlying Bitcoin needs to be verifiably held somewhere by "custodians" - be they highly trusted institutions with multisig keys, a decentralized custodian in the form of an incentivized network, or some form of hybrid approach - all with the design of allowing Bitcoin holders to feel safe having their Bitcoin held in return for the ability to deploy a native Ethereum token representation.

Now that we know why Bitcoin needs to be wrapped in order to participate in DeFi, let's look at the various ways you can get it.

Buying wrapped Bitcoin on a centralized exchange or via a DEX

There are three main ways to get BTC into DeFi.

Option 1 - Centralized Exchanges

You have the option of purchasing WBTC, HBTC or renBTC directly on centralized exchanges such as Binance, FTX, Huobi, Coinbase or Kucoin, but of course this comes with the standard caveats that centralized exchanges carry, such as not owning the private keys and having to KYC (although fiat on-ramping without KYC is an art unto itself). From there you can send your WBTC to an Ethereum wallet and head on out into the DeFi ecosystem.

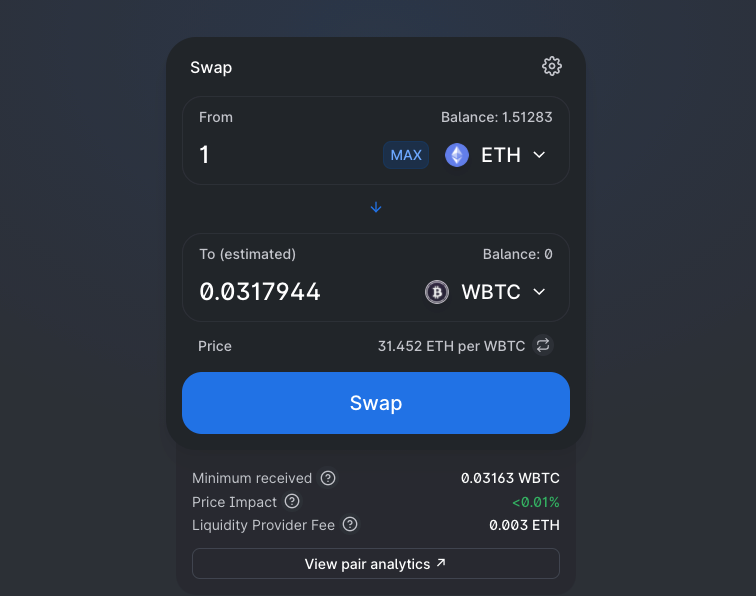

Option 2 - Decentralized Exchanges

If you already have ETH in an Ethereum wallet, then the journey to getting wrapped Bitcoin is even easier - you can head over to a decentralized exchange such as Uniswap, Sushiswap, 1inch or Bancor and trade ETH for WBTC or renBTC, and in a couple of minutes you'll have some fresh bales of ERC-20 BTC ready to lug out onto the fields for a solid day of good, hard farming. The benefit of this approach is that there's less work and you are able to buy wrapped Bitcoin that can later be redeemed for actual Bitcoin once you're happy with your yield.

Option 3 - WBTC Cafe

The third main option for getting WBTC is to use wbtc.cafe, an ultra-basic looking site that will swap BTC to WBTC and vice-versa. The cafe is very simple - input the amount of BTC you'd like to convert to WBTC, and add an Ethereum wallet address that you'd like to receive the WBTC. Then send the chosen amount of BTC to an address you'll be given, and in return an equal amount of WBTC minus both RenVM and Bitcoin network fees will be sent to your Ethereum address.

Personally my recommended methods of swapping BTC to a wrapped representation is to use options 1 or 2, as the wbtc.cafe method is both slow & mildly terrifying.

The different Bitcoin tokens on Ethereum

What is WBTC?

WBTC is "Wrapped Bitcoin"; an Ethereum ERC-20 token that is backed on a 1:1 basis with custodially-held Bitcoin, and is currently the most widely-used method of bringing BTC to DeFi, accounting for ~72% of all the BTC on Ethereum. The community-led project (initiated by parties including Kyber Network, Ren, and BitGo) was launched on the Ethereum mainnet in January, 2019, and aims to help bring the huge volume of Bitcoin trading over to the Ethereum ecosystem.

To facilitate the conversion from Bitcoin to WBTC, and to assure the fully-collateralized backing of WBTC with BTC, users initially convert their BTC through a trusted WBTC partner. You can personally verify that the WBTC is backed by an equivalent amount of BTC through a "proof of reserve" system. WBTC is governed by the WBTC DAO, which makes decisions on adding & removing merchants and custodians via a multisig contract. With that being said, the default option is to purchase WBTC that is already on the market via a CEX / DEX.

Once BTC has been converted to WBTC, a range of opportunities emerge, such as the ability to earn interest on bitcoin by lending WBTC, utilizing Bitcoin-centric protocols like Badger to earn yield, or provide liquidity to pools on decentralized exchanges such as Sushiswap and Uniswap.

There is a credible argument that WBTC does not adhere to true decentralization, and that the system is in the same class as the Circle-governed USDC. The WBTC system entails a reasonably high custodial risk as the BTC for WBTC is held in custody by a multi-sig wallet, which means that it is relatively centralized, and is also slow to be released on demand, unlike a hybrid-decentralized solution like renBTC.

Instead of covering HBTC in its own section, it should be enough to say that HBTC stands for Huobi Bitcoin, and is Huobi exchange's own version of wrapped Bitcoin. HBTC accounts for around 12% of the wrapped Bitcoin currently on the market, and is a centralized, custodial option like WBTC.

A brief introduction to Ren: RenVM, RenBridge and renBTC

Ren is a decentralized protocol, designed as a solution to bridge assets across blockchains. One of the assets issued by the Ren protocol is renBTC, an ERC-20 token that provides an Ethereum-network representation of underlying Bitcoin. renBTC is backed on a 1:1 basis and is redeemable for the underlying BTC. While under the hood there are large technical differences, trust assumptions and custody methods between WBTC and renBTC, the simple explanation is that in both cases BTC is given to a custodian in exchange for an Ethereum representation.

The difference in technical details, however, is that Ren is largely decentralized rather than relying solely on a set of trusted parties, and this allows RenVM to facilitate the process at a much faster rate. The architecture is supported by Ren Darknodes - nodes that host the RenVM, incentivized by being compensated in with fees that are paid by the user for cross-chain movement. These darknodes are bound to act honestly because they have to put up collateral which gets slashed if they don't adhere to the rules of the Ren protocol.

RenBridge

RenBridge is the user interface that enables you to bridge BTC to renBTC. RenBridge 2 was released on the 15th of February, 2021, and brings BTC, BCH, Zcash and Doge to Ethereum and Binance Smart Chain.

Earning yield on Ethereum with your wrapped Bitcoin

So now that you've got your Bitcoin on the Ethereum network, it's time to start generating some sweet yield. I'll use the example of having WBTC and putting it to work in this section. The first thing we need to do is choose a DeFi protocol that provides a solid APY for WBTC, so let's check out Curve Finance.

Curve is one of the most trusted and popular automated market makers (AMM) in the DeFi landscape, and the Curve sBTC pools are very attractive, with APYs as high as 20%. In order to contribute to the sBTC pool you need to have sBTC, renBTC or WBTC in your Ethereum wallet, as well as some ETH in order to pay for gas. We can then visit Curve, and go to the sBTC pool to deposit our WBTC.

We could provide one or all three versions of wrapped Bitcoin to the pool, but in this case we just provide WBTC. Behind the scenes Curve does some magic and will split the WBTC that we deposit into the three different types of wrapped Bitcoin needed to provide liquidity to the pool.

We could provide one or all three versions of wrapped Bitcoin to the pool, but in this case we just provide WBTC. Behind the scenes Curve does some magic and will split the WBTC that we deposit into the three different types of wrapped Bitcoin needed to provide liquidity to the pool.

Select "Deposit and stake in gauge", and your Metamask will prompt you for approval of the transaction fee.

Once that's done you can head over to the "Profit" page where you'll see your accrued profits in your selected denomination (BTC, USD, tokens).

Over time, your staked Bitcoin will start earning fees that are collected by Curve and distributed to liquidity providers. The fees themselves are compounding, meaning that your collected fees go back into the pool and earn more fees on your behalf. You can claim your rewards at any time, of course but with Ethereum gas fees being as they are you'll probably want to wait until you've collected a reasonable amount to make it worth your while.

If you feel like you've farmed enough profit to be satisfied, or would like to put your Bitcoin to work somewhere else, you can always withdraw your deposited WBTC via the Withdraw page.

If this all sounds like a lot of work, you're not wrong! Luckily, there is another option that removes a lot of the extra steps, one that is now acting like a magnet for a lot of the Bitcoin entering the Ethereum ecosystem.

Enter Badger - The Schelling Point for Bitcoin on Ethereum

With the growing interest in bringing Bitcoin as collateral to DeFi, a dominant player has emerged in the recent months in the form of the fair-launched, community-owned Badger DAO, a strongly YFI-influenced project focused on optimizing wrapped Bitcoin yields. The primary benefit of using Badger rather than managing the yield farming yourself is that Badger identifies and aggregates virtually every Bitcoin-based opportunity into one place, and adds some sweetener into the bargain in the form of Badger's governance token: BADGER.

Badger offers yield-generating opportunities in the form of Sett's - tokenized Bitcoin vaults that model Yearn.Finance V1 vaults, allowing users to deposit assets and gain access to automated strategies across DeFi protocols.These Setts sit on top of DEX liquidity pools, such as Curve's renBTC, sBTC and tBTC pools, which themselves offer yield in exchange for adding liquidity. Let's take a look at how an automated strategy works, using Badger's sBTC SETT Vault:

-

Deposit wrapped BTC into the Badger sBTC pool

-

Receive back a sBTC LP (liquidity pool) token

-

The sBTC LP token is deposited into the BadgerDAO vault

-

The vault accrues value via swap fees & harvests CRV

-

$BADGER governance token can be claimed periodically

Badger places a really strong emphasis on the community, and has assembled a talented and constantly growing team of "Badger builders" who take it upon themselves to expand the ecosystem, improve existing products and create new products that strengthen the value of the Badger DAO. There are lively discussions about new ideas & proposal in the Badger discord, and a growing number of online evangelists, including crypto influencer & recently-elected Council of Badgers seat holder Gabriel Haines:

"Badger has a very simple narrative - to bring BTC to DeFi...if you want to come into DeFi today with your BTC first you need to go to wbtc.cafe to wrap, then you need to go to Curve to LP, then you need to go to Yearn to automatically lock in your yield. This process is hard. Badger is building a platform that will allow BTC holders to get into DeFi all on one page in a few clicks."

One of the main benefits of using a yield aggregator like Badger is that the often painful gas fees associated with managing staking & LPing is "socialized" - the costs are distributed across all members, leading to smaller overall fees while at the same time enabling an individual user to enjoy the benefits of intelligent rebalancing strategies, without needing to know all of the technical details of the underlying protocols, so using Badger gives the Bitcoin user access to largely passive DeFi investing.

While at the moment the BADGER token that is offered as part of the yield rewards when staking & LPing via badger.finance ostensibly has no intrinsic value outside of governance, it should be noted that all fees generated via the Badger dapp go to the Badger DAO treasury, and holders of the BADGER token are able to vote on future proposals that could choose how to distribute these fees.

What are the risks of using Bitcoin on Ethereum?

Moving your Bitcoin to the Ethereum network isn't risk free. It's important to understand that and to be aware of the risk-reward before you start moving your hard-earned Bitcoin across, some of the risks are outlined below:

- When you use a custodial service like WBTC, you are trusting a centralized or partially-decentralized entity and its associated infrastructure, which entails associated systemic and human risk

- Exposure to 51% attacks on both the Bitcoin and Ethereum networks

- The RenVM network entails certain unique risks based on the network design, including collusion and attacks on the network

- There is always smart contract risk on the Ethereum network, and audited contracts are no guarantee of safety

- Yield is often delivered in the form of a protocol's governance token, which in itself may not have intrinsic value or may drop sharply in value in comparison to Bitcoin, ultimately leading to much lower realized yields

Ultimately the safest place to keep Bitcoin is on Bitcoin, but with the risks being understood the potential return generated on bridging BTC to Ethereum can make it worthwhile. If you enjoyed this tutorial and would like to discuss it with fellow crypto enthusiasts, hop into our community Telegram channel.

BasedXeno

6 months ago ·

11 min read

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

How to buy bitcoin

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials