What is Pickle Finance?

Emanuel Coen

10 months ago ·

5 min read

One of the hottest new types of applications being developed in the DeFi space at the moment are on-chain asset management protocols. As more and more applications join the DeFi space everyday the number of good investment opportunities rises exponentially.

This abundance of opportunities is both a blessing and a curse. It’s a blessing because there is good money which helps to attract new people into DeFi and experience the magic of Web3. It’s a curse because investors have to constantly scan the market and chase the highest DeFi lending rates themselves which is both time and resource expensive as every transaction on the Ethereum network incurs transaction fees. The average investor just wants to invest once and let the money work.

This is what Pickle.Finance and other DeFi asset management protocols do. Pickle’s mission is to be your one-stop shop for maximizing your returns in crypto with the lowest amount of effort. User funds are pooled in smart contracts which have automated strategies to put those funds to productive use and get higher returns than one would by simply putting money into a lending protocol like Compound or Aave. When a strategy becomes outdated a new strategy is developed by the Pickle community. As of the time of this writing, people have entrusted more than $145 million dollars with Pickle and the Pickle community has made a name for itself as one of the most vibrant and active communities on Twitter.

How does Pickle work?

At the center of the Pickle product suite are so called “Pickle Jars”. Pickle Jars allow users to deposit tokens from liquidity pools such as Uniswap or Curve, and then execute sophisticated strategies that maximise the returns of the depositor.

The 0.69 Jars series for example, auto-harvest the Uniswap $UNI token which is distributed to Uniswap liquidity providers, sell those tokens, and purchase more Uniswap liquidity tokens on behalf of the user. If you were a “normal” liquidity provider on Uniswap, staking your LP tokens in Uniswap you would have to do this process manually by yourself: wait a couple of weeks until you have accrued enough $UNI tokens, claim them and then sell (or not). Pickle automates this process for you and spreads the gas fee costs across all its users thereby achieving considerable economies of scale.

Note that by being in these Pickle Jars you’re effectively short $UNI since you’re selling them to increase your ETH - DAI/USDC/USDT. If you want to hold $UNI tokens this is not the right strategy for you.

PickleJars: The backbone of the Pickle protocol

Although every Pickle Jar strategy varies slightly, most of them have in common that they try to stabilize stablecoins. As you might know there are various stablecoins that exist on the Ethereum Blockchain. While some are centralized (USDC, USDT) and backed by “real dollars” in bank accounts, others like DAI and sUSD are decentralized which means they are issued by smart contracts and backed by crypto assets (ETH, SNX).

For these decentralized stablecoins to work at scale it is crucial that they trade at parity (1:1) with the dollar so people can rely on their stability. In the last couple of months however, they have often traded at a small premium (1.01-1.04) because the demand for DAI and sUSD has been astronomical. Since these stablecoins are 100% censorship-resistant (can’t blacklist addresses) they are more popular and often offer higher yields in DeFi protocols than their centralized counterparts. A centralized stablecoin issuer would simply respond to this demand by issuing more stablecoins but decentralized stablecoins can not do this - they rely on people opening vaults and collateralizing their ETH or SNX which they can not directly control. This is when they start trading at a premium.

Pickle offers a simple mechanism to bring stablecoins back to peg: it distributes its $PICKLE token to liquidity providers and adjusts the weights dynamically. When a stablecoin is above peg (e.g DAI), the protocol will distribute fewer PICKLEs to that pool and more PICKLEs to other pools (USDC, USDT). As farmers chase the best yield, this creates sell pressure for the overvalued stablecoin (DAI) and buy pressure for the other coins. This works in reverse for stablecoins that are below peg. This strategy is replicated across all its Jars. To stabilize sUSD, it offers a range of Curve related Jars.

To make the process of swapping between different pools dead simple Pickle offers an integrated “Swap” feature, allowing users to change their LP position from one stablecoin pool to another in a single click. The ease of swapping helps off-peg stablecoins return to their peg faster.

However, in recent weeks the Pickle Community has decided to move away from the narrow focus on stablecoin jars to more broad strategies including governance tokens and new protocols. It's new mission: "Highest yield. Lowest risk. Longest time. ". Essentially to be consistently delivering higher returns than most of the market without incurring too much risk.

If you want to get a sense of what's ahead for Pickle in the near future, check out a rare podcast interview with Pickles anonymous founder Larry the Cucumber on the Gabriel Haine's show.

Pickle Tokenomics

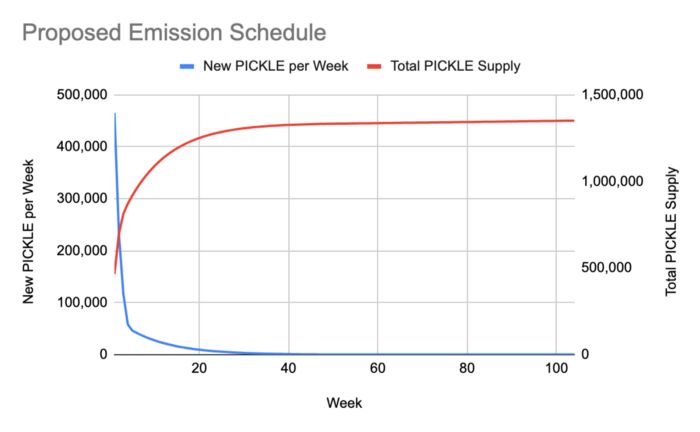

Unlike other on-chain asset management asset protocols like yearn.finance, which has a fixed supply, Pickle has an inflationary supply. As you can see from the supply schedule the majority of PICKLE tokens (1.3M) will be distributed by the end of this year after which there will be a constant inflation of 1.29% per year.

This means Pickle has an efficient mechanism at hand to incentivize behaviours that it deems important. At the moment, 70% of new PICKLE tokens are distributed to PICKLE-ETH liquidity providers on Uniswap to create deep liquidity and 30% are used to incentivize Jars ( with changing weights as we discussed).

Pickle tokens can be used to vote on governance proposals and to stake. When you stake PICKLE tokens you receive a proportionate share of the profits from the PickleJars, which the protocol generates by charging users a 27.5% performance fee. These staking rewards are paid out in ETH.

Conclusion

Pickle Finance is a really interesting project offering consistently high APRs and delivering innovative strategies at lightspeed. Unlike many other “farm” projects that create valueless tokens, Pickle generates real cash flows which PICKLE holders can capture by staking. With the inflation being significantly reduced at the beginning of next year things could get very interesting for Pickle soon.

Pickle has carved out a very nice focus area for itself in the DeFi space by making stabilizing synthetic assets a strong pillar of its product. In the future as Pickle’s TVL grows, issuers of synthetic assets might even work directly with Pickle to steer liquidity providers to their asset’s pool to ensure there’s sufficient liquidity. There could also be more vaults to stabilize WBTC/renBTC/tBTC and other assets. It will also be interesting to see new Pickle Jars being implemented as the community has decided to diversify away from just stablecoins to more exotic strategies.

One thing that must be said about Pickle is that the team is anonymous and user funds are controlled by a multi-sig consisting of mostly team members. However, so far, the team has been extremely transparent shown a lot of integrity in all its decisions from token distribution to governance decisions.

Emanuel Coen

10 months ago ·

5 min read

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

How to buy bitcoin

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials