What is Decentralized Finance (DeFi)?

Emanuel Coen

over 1 year ago ·

15 min read

Heard about Decentralized Finance and wondering what all the hype is about? You've arrived in the perfect place.

In this post we'll answer all your questions:

What is decentralized finance?

How is decentralized finance different from traditional finance?

How to value DeFi tokens?

How to get started with DeFi?

And what are examples of DeFi applications?

What is Decentralized Finance (DeFi)?

Decentralized finance is one of the areas in crypto that has received notable traction. At a high level, DeFi aims to re-create the financial system that we use today but in a way that removes all trusted intermediaries like banks.

Bitcoin, the first decentralized network, laid the foundation for this movement by facilitating trustless peer-to-peer payments. This means you can send bitcoin to anyone in the world without having to know or trust that person AND without using a service like a bank. In addition to these features, bitcoin has other attributes hardcoded in its protocol. Probably the most important one is its supply cap, which dictates that there are only ever going to be 21 million bitcoin in total. This scarcity is why Bitcoin is often classified as 'digital gold'.

When people recognized the power of the Bitcoin network they immediately started thinking about how it could enable more use cases, beyond simply storing the state of bitcoin ownership. Determined to find a solution to this problem a young Bitcoin enthusiast named Vitalik Buterin set out to create Ethereum in 2013. On a technical level, Ethereum is a sort of 'world computer' that can store both code and data. Like a normal computer, Ethereum can execute code and it uses the Ethereum blockchain as it's hard drive. Everytime code is executed and data is changed, the state of the blockchain is updated. However, unlike a traditional computer, Ethereum state changes are governed by the rules of consensus and the state is distributed globally, meaning that the data is held collectively by thousands of nodes.

These building blocks made Ethereum the perfect candidate to host new types of applications. Applications that are:

Decentralized - Applications that can run without any single central entity controlling them, governed by their users.

Censorship resistant - Applications that can not be taken down by a government nor any other actor.

Permissionless - Applications that can be built and used by anyone in the world without any geographical limitations.

While in theory, Ethereum can host any kind of application, decentralized finance is the sector that is currently being explored most. Decentralized finance encompasses a broad spectrum of applications that try to replace banks and other financial institutions, i.e applications that revolve around trading, lending, borrowing and investing.

What are the differences between traditional finance and DeFi?

In traditional finance when you go to your bank accounts' website or mobile app, the entire application logic is hosted on a server controlled by your bank. Your bank account balance and your personal information is likewise stored in a database that your bank controls. Decentralized finance turns this logic on its head. We'll look at a few of the differences between using a bank account and a DeFi application.

Custody & Storage

In decentralized finance your assets are stored in an account on the blockchain instead of a database. Whereas your bank can freeze your assets any time, no one can stop you from accessing your assets on the blockchain. There is no single server that can be shut down. To take your assets from you, someone would need to shut down the entire blockchain, which is nearly impossible given that it is run by thousands of geographically distributed computers. Your account is not represented by a name and a bank account number but a public and private keypair. The public key is public and identifies you to the network (e.g when you want to receive funds from a friend) and the private key is what you need when you want to send funds to another Ethereum account. Miners verify all transactions and only validate those that include truthful digital signatures.

It's completely free to open accounts on the blockchain. If you're tech-savvy you can spin up a node and generate as many addresses and accounts as you like. However, most users use an Ethereum wallet to create an account. Wallets are interfaces that make it extremely easy to interact and communicate with the Blockchain. When you download a wallet and set it up, the wallet automatically generates a public and private key. When you send assets to another address your wallet produces the needed signatures and submits the transaction to the Blockchain where it is then processed and validated. In short, the wallet is your ticket to the financial system existing on the Ethereum blockchain. Unlike a bank account where you have to identify yourself, nobody will turn you down when you want to get an Ethereum wallet. They're all free and open-source.

Low Friction

Another difference between an Ethereum account and a bank account is that the former gives you complete freedom on which interface you want to use. You can download an Ethereum wallet, copy the private key and then import it in another wallet application and you'll see your balance immediately reflected in the interface. Imagine if you could import your bank account in whatever banking app you wanted and switch between Bank of America and Wells Fargo in seconds. This is a reality in the crypto world because a wallet is just an interface that reads from the blockchain. The blockchain is public and accessible to anyone.

Switching between DeFi applications is equally seamless. The concept of 'signing-up for a website' and being locked with the provider doesn't exist. If you want to use a DeFi application you go to the website where the application is hosted. As soon as you connect your wallet, you can use the application. You're 'signed-in'. The only difference is that no personal data is stored. You can hop from one application to the other in seconds.

Connecting your wallet takes one click

Connecting your wallet takes one click

Permissionless

Moreover, on Ethereum, developers can just start building whatever they have in mind. They don't have to ask for permission nor is there any red tape involved. In traditional finance it is extremely hard to build a product. Especially, if you're trying to build something new. This has stifled innovation in finance in the last decades.

On Ethereum, literally anyone can build an application. Developers who have an idea on how to build an exchange, a synthetic dollar or an option market that is more efficient than existing ones, can simply do it. For the first time in history, developers from the whole world are joining efforts and building on the same platform. Whereas the traditional financial system is extremely fragmented, Ethereum provides a global settlement layer that transcends borders and nationalities. A sandbox for innovation.

Interoperable

Another key characteristic of decentralized finance is that all the smart contracts are public on the chain. Open source by default. Anyone who knows how to code can trigger the functions of these smart contracts. As a result, anyone can also build an interface to these smart contracts.

For example, the team behind Uniswap, a decentralized exchange that allows users to exchange tokens, has developed one interface that users can visit at uniswap.exchange but numerous other interfaces exist that are hosted by other teams and individuals. This means that not only the backend of these applications, a.k.a the smart contracts, can't be taken down, even the frontends/interfaces are censorship resistant and decentralized. The teams behind the smart contracts even encourage this by making the frontend code public as well.

One protocol, many interfaces

One protocol, many interfaces

But there is another interesting characteristic about these smart contracts. Because they are public and exist on the same computing platform they can talk to one another. This is called interoperability. It essentially means that if I am building a new application I can integrate any existing smart contracts into my application.

Let's say I am building a lending protocol. The lending protocol has two main functions. Users can deposit money into a pool and earn interest on it. And borrowers can borrow assets from that same pool. However, to secure the loan they'll have to deposit assets as security for the loan. This is similar to how loans in traditional finance are backed by a mortgage or other collateral. What happens when the value of the crypto held as collateral for the loan by the protocol drops to 0 though and the borrower doesn't pay back the loan? To make sure this can't happen the protocol would need a liquidation mechanism whereby it sells borrowers' risky collateral on the market and refunds the lenders. Instead of having to build an exchange from scratch, as well as the lending market, I can just integrate Uniswap in my protocol. Everytime collateral is at risk, the protocol would take it and sell it on Uniswap. The proceeds would go straight into the protocols pool and ensure that it stays solvent.

Interoperability is powerful because it means that every new application that is being built can benefit from the ones that already exist. With every application being built, Ethereum as a whole becomes more useful and powerful. This is why Ethereum is so dominant. No developer wants to build on a new Blockchain with no applications. Even if it promises millions of transactions per second.

Governance

In the traditional world companies (like your bank) are managed by executives, typically supervised by a board and ultimately owned by shareholders. The vast majority of companies are private meaning that the shares are not publicly traded and the average joe can not buy a share of ownership. Those that are public are pretty expensive by the time they are traded on stock exchanges. By the time a company like Facebook goes public, venture capital funds have already made their profit. They invest in companies when they're dirt cheap and sell off their shares to the public years later at billion dollar valuations.

In contrast, most protocols are owned and governed by their community. Anyone can submit proposals or code changes to a protocol which then get accepted and implemented or rejected by the community. To participate in the decision making users need to buy the governance token. Token holders also typically receive a portion of the fees that the protocol collects for its service.

In that sense they are a new asset class. Similar to stocks but different because they give holders ownership over a protocol not a legal entity. Since the cash flows these protocols generate are public, anyone can make informed decisions, without having to wait for a company to report earnings once a quarter (and not being sure if the reported earnings are accurate).

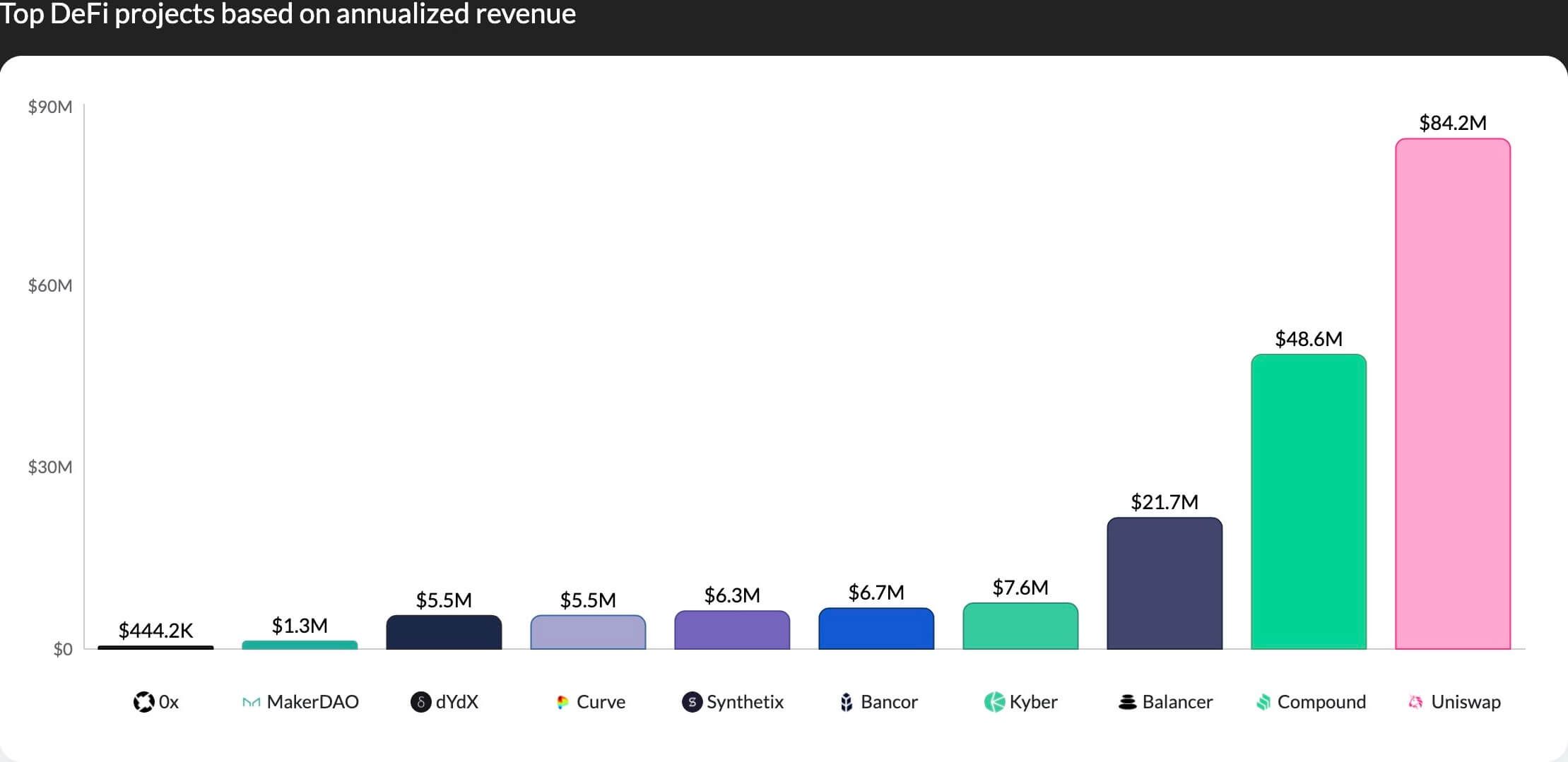

By having a transparent mechanism for calculating a protocol's earnings, we can apply one of the age old metrics for valuing capital assets in traditional finance—the PE Ratio. Simply put, the PE Ratio is a way to understand how the market is valuing an asset relative to the amount of revenues it generates. As an example, Compound’s protocol token ($COMP) has a PE ratio of 40. This means that investors are willing to pay $40 dollars for every $1 dollar earned by the protocol today. If you want to check out the PE ratio of the most popular DeFi applications, Token Terminal does a great job at providing accessible data.

Annualized Earning of Top DeFi projects, August 2020

How to get started with DeFi?

To get started with Decentralized Finance you'll need some Ether and a wallet. To buy Ether you need to go to a centralized cryptocurrency exchange. Exchanges allow you to convert your fiat currencies into cryptocurrencies. Once you have acquired Ether, you need to withdraw it to an Ethereum wallet. Theoretically, you could also buy other Ethereum tokens straight away but you'll always need some Ether to pay for transaction fees.

1. Buy Ether (ETH)

To buy ETH, we recommend Coinbase, Blockchain.com or Kraken. If these exchanges don't operate in your country refer to our cryptocurrency exchange page for a more comprehensive overview.

2. Get an Ethereum wallet

As for a good DeFi capable Ethereum wallets, we recommend Argent, Metamask or Authereum. Metamask is the most popular wallet. It runs as a browser extension and pops up when you need to connect your wallet to an app or sign a transaction. Argent is a slick, incredibly user-friendly mobile wallet. It has many DeFi integrations natively integrated in its mobile app but you'll be slightly more constrained in terms of choice than with Metamask. Ultimately, it comes down to personal preference as Metamask is used on desktop/web whereas Argent is used on mobile (iOS/Android).

3. Withdraw ETH from Exchange

As long as your ETH is in your exchange account you’re not truly holding it. To start using DeFi you need to withdraw it to your Ethereum wallets.

4. Get started with DeFi

One good place to start your DeFi journey is by heading to uniswap.exchange and swapping a portion of your ETH for tokens. You could for example swap Ether for USDC, a dollar stablecoin. Once you have USDC, you could head to Aave and deposit it there to earn interest. Check out our DeFi page for other examples of DeFi projects along with instructions on how to use them.

Examples of DeFi applications

The DeFi ecosystem keeps growing with new protocols and applications emerging almost everyday. To give you an idea of the type of financial applications that are built already today on Ethereum, we'll cover some of the most interesting projects that exist today.

The DeFi ecosystem

The DeFi ecosystem

What is MakerDao?

Naturally, for these applications to be useful they need to work with dollars not just cryptocurrency. The dollar is the most stable currency in the world. Many people in the world wish to get exposure to it but can't because they live outside the geographical boundaries of the United States. That's why stablecoins or 'crypto dollars' emerged very early on in the history of crypto.

Stablecoins like Tether or USDC are tokens that exist on the Blockchain and are pegged 1:1 to the value of the US dollar. They are issued by private companies (often cryptocurrency exchanges) who guarantee that they hold the equivalent amount of dollars in bank accounts. However, to redeem those tokens for actual dollars, holders need to go through a KYC procedure. Issuers need to comply with existing anti-money-laundering regulations. The market cap of stablecoins on Ethereum has exceeded $10 billion dollars and keeps rising.

However, these stablecoins are not decentralized. Although, they can be exchanged freely within the Ethereum ecosystem, to actually redeem them against fiat dollars, individuals must identify themselves with these stablecoin issuers. Furthermore, the smart contracts that power these stablecoins have special functions built in, which allow issuers to blacklist certain addresses or freeze assets.

The aim of the MakerDAO protocol is to create a stablecoin without any of these limitations. One that isn't issued by a company. One that is truly decentralized, governed by a protocol and held stable to the dollar by collateralizing ETH.

The main function of the MakerDAO protocol is to issue DAI, a stablecoin that tries to always be worth $1. However, DAI is not backed by real dollars in a bank account which is why the value of DAI (expressed in dollars) can sometimes fluctuate slightly. Instead, DAI is backed by Ether and generated through a process, in which any person can send Ether into a smart contract (called a 'Vault') where it’s temporarily locked. In return the user receives DAI. For instance, if a user sends $150 of Ether they would receive 100 DAI, i.e ⅔ of the Ether locked in the smart contract as collateral.

How MakerDAO works

How MakerDAO works

After, the user can send the DAI to anyone in the world or sell it and buy something with the money. Effectively, the user has borrowed DAI from the Maker Vault but since the smart contract holds the user’s Ether back as security, there’s no default risk whatsoever. When the user wants to get the Ether back he needs to pay back the principal of the loan as well as the accrued interest over the loan period.

Of course, not everyone needs to go through this process to obtain DAI. Only users who have financing needs or want to take a long position, actually mint DAI. Most users simply buy DAI on an exchange. In most cases they'll pay exactly one dollar. Now, like any currency that’s traded on free markets, DAI derives its value from demand and supply.

If too many people sell DAI to buy other cryptocurrencies for example, the value of DAI can fall under $1. In that case, there are two forces that bring the market price back to $1.

1) Arbitrage

One is that people who have taken out loans will use the opportunity to pay back their debt at a discount, buy DAI for cheap on the market (e.g $0.95) and close their debt position. The 100 DAI that were initially borrowed will only be worth $95 now so there is an arbitrage opportunity to be seized. This increases the market demand for DAI and at the same time, the supply of DAI is stifled because DAI is being paid back to the smart contracts and burnt there.

2)Interest rates

If the market forces alone don't bring the price back to $1 the Maker Organization, which is governed by thousands of individuals who collectively vote on policies, can additionally raise the interest rate. By making it more expensive (or cheaper) to borrow, users will close (or open) their Maker Vaults, thereby reducing (or increasing) supply.

In other words, these smart contracts work like a decentralized 'central bank' that mints currency, adjusts incentives and makes sure that DAI tokens are always backed by a sufficient reserve of Ether to maintain their stable value.

What is Compound?

Compound is a decentralized lending protocol that lets people borrow & lend assets by providing a liquidity pool that anyone can either borrow from or lend to. Users wishing to lend money, can send their assets to the liquidity pool and immediately start earning interest. The interest generated from the entire pool is distributed across all suppliers so even when funds are not being used, suppliers receive their share of interest.

Users wishing to borrow money from the liquidity pool have to provide collateral just as in the MakerDAO system, which guarantees the security of the loan at any point. The interest rates are set algorithmically based on supply and demand which means that they fluctuate. If a lot of DAI is supplied to the pool and there is not enough demand to match it - the interest rate for DAI will be lowered. Low supply and high borrowing demand, on the other hand, will lead to an increase in the interest rate.

Compound works not only with DAI but many other tokens that exist on the Ethereum Network. Each token has its own liquidity pool and own interest rates. At the time of writing, Compound supports lending & borrowing of Ether, WBTC, BAT, USDC, DAI and several other assets.

What is Pool Together?

To show how composable these different DeFisystems are, we'll finish by explaining PoolTogether, a no-loss lottery that uses both DAI and Compound in its product. It allows users to pool together their funds and collectively invest into the DAI pool of the Compound protocol. As the money sits in the the Compound pool it generates interest, which is paid out as a weekly prize to a random wallet address. For every DAI users contribute to the pool they get a lottery ticket in form of a token.

Effectively, users have a chance to win the weekly prize without the risk of losing any money. They are free to withdraw the sum they invested at any point in time. Two more advantages PoolTogether has over traditional lottery 1) the code is fully open-source and auditable so users can be assured that the prize distributions aren't rigged and 2) PoolTogether has contributed more than $300k DAI of its own money to the pool, which generates interest but is not eligible to win.

Summary

These are just a couple of examples of decentralized finance applications. There are others and many more applications joining every week developed by young developers from all over the world. The magic with decentralized finance is that it is global by definition and it can be used by anyone in the world with a smartphone - even by the 1.7B people without a bank account. They are powered by open-source code which is auditable for anyone. Compare this to the highly centralized, opaque and rent-seeking financial system that we live in and you'll understand why this vision fascinates the crypto community.

If you have any questions, feel free to message us on https://t.me/joinchat/F35yUk4NMhJtJUO or https://twitter.com/cryptotesters. We're there to help!

Emanuel Coen

over 1 year ago ·

15 min read

Latest Content

August 2021

How to make money selling options with R...

June 2021

Top 5 Crypto Lending Platforms to Watch ...

June 2021

What is Hop and how does it work?

May 2021

What are NFTs: Environmental Nightmare, ...

April 2021

Sam Bankman Fried from FTX on his Master...

April 2021

Stefaan Ponnet Founder of AvadoCloud abo...

April 2021

Alex Salnikov from Rarible.com on NFTs, ...

March 2021

Nate & Mark from Bancor on Building a Ne...

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

How to buy bitcoin

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials