How to think about savings rates in crypto

Emanuel Coen

about 1 year ago ·

14 min read

Introduction

Lending and borrowing cryptocurrencies is becoming an increasingly important sub-sector of the crypto industry, one that may end up shaping how the underlying assets themselves are valued and priced in markets. Until recently, the two mantras in crypto have always been to HODL (hold) and keep crypto assets in self-custody - not your keys, not your coins. Unsurprisingly, crypto savings accounts, where users relinquish control over their assets in exchange for high interest rates, are a controversial topic in the crypto community.

On the other hand, since many crypto enthusiasts invest in crypto with a long-term mindset anyway, the idea of letting assets generate a return regardless of the price appreciation of the underlying asset is an appealing one to many. If implemented properly, crypto savings accounts have the potential to draw in new investors while encouraging the movement of crypto capital out of storage and into markets, thereby facilitating adoption and new use cases for crypto.

Interest rates are important in financial markets because they fill the gap between people with surplus assets they can’t use, and people who need assets because they have a productive or investment use. By trading the time value of an asset, both parties benefit in a non-zero-sum manner. For blockchain assets, vibrant lending markets are important because:

-

Borrowing mechanisms are extremely limited, contributing to mispriced assets (e.g. “scamcoins” with unfathomable valuations because there’s no way to short them).

-

Blockchain assets have negative yield, resulting from storage costs and risks (both on-exchange and off-exchange), without natural interest rates to offset those costs.

In this analysis, we explain what crypto savings accounts are and untangle the different models that exist. The aim is to provide a framework for investors to make it easier to assess risks and make informed investment decisions.

How do crypto savings accounts work?

Crypto savings accounts work in a similar way to normal bank savings accounts. In a nutshell, you lend money to an institution which lends your assets to borrowers in need of liquidity. However, these loans are relatively secure since the loan providers ask the borrowers to deposit crypto assets themselves, as security for the loan. Most providers ask for a ‘loan-to-value’ ratio of 50% meaning that if a borrower wants $1000 they’ll need to deposit $2000 worth of bitcoin for example, as security for the loan.

Who are these lending providers lending my assets to?

Most commonly, these are institutions and individuals that hold cryptocurrency and need short-term liquidity but don’t want to sell their cryptocurrency. Furthermore, they wouldn’t be able to receive loans against their crypto assets as easily from traditional lending providers such as banks that are reluctant to handle crypto assets.

To give a few examples of the type of companies using crypto-backed loans:

-

Cryptocurrency Miners: need financing to cover their operating expenditures (pay employees, electricity costs etc.).

-

Traders: want to seize arbitrage opportunities and need short-term liquidity to execute profitable trades.

-

Hedge funds: have invested in ICO’s or other digital assets and want to leverage their position to pursue more investment opportunities.

-

Cryptocurrency Exchanges: need financing for their margin lending and trading services.

How are interest rates determined and why do they differ between providers?

Generally speaking, interest rates in a given market are determined by supply and demand. If there’s a lot of borrow-demand for a specific asset, interest rates for that asset will naturally go up in order to incentivise more lenders to deposit that asset. Looking at one of the borrower profiles mentioned above, namely traders, demand for stablecoins like USDT would for example go up when traders pursue a long-strategy ( to buy crypto with the borrowed USDT ) and demand for crypto assets like BTC or ETH would go up when traders pursue a short strategy ( to sell the crypto and reimburse later when the asset is cheaper). As such, interest rates for any given asset are a product of the aggregate demand and supply of all borrowers and lenders.

1. Different Operating models: DeFi vs CeFi

Interest rates can vary significantly between providers. One reason why they differ is that the platform where the loans originate from have different operating models. Broadly speaking, there are two types of lenders in the crypto industry: centralized crypto lenders (CeFi) and decentralized lending platforms (DeFi).

Centralized Crypto Lender (CeFi)

A company that provides cryptocurrency lending services, is often subject to regulation, identifies its users, and controls its software platform and data. From a consumer perspective, these providers have the advantage of paying out loans in fiat (dollars, euros etc.) due to their banking relationships. Funds are held in custody by the provider making them somewhat similar to traditional savings accounts. Furthermore, their client base often consists of institutional investors since they are able to offer bespoke deals, offer 24/7 customer support and other services that matter to institutional clients. As a result of this significant borrowing demand by institutions, they are able to offer more stable savings rates than DeFi protocols.

Examples: BlockFi , Nexo, Celsius, Unchained Capital

Decentralized Lending Protocol (DeFi)

Permissionless lending protocols are systems that allow users to lend and borrow various different digital assets typically through so-called “smart contracts” on the Ethereum blockchain. The smart-contracts powering these protocols run without a central authority. They are hosted and executed on the Ethereum Blockchain making them permissionless and censorship-resistant. Additionally, these protocols are non-custodial, meaning that unlike centralized lending platforms, lenders remain in control of their deposited funds at all times. In the Compound and Aave protocol for example, users receive tokenized representations of their share in the liquidity pool, which they can redeem against the underlying asset at any time. The only caveat to this occurs when all the funds are borrowed in the liquidity pool. In this instance, lenders would experience longer waiting times.

It’s important to understand that DeFi protocols are not companies in the traditional sense. Instead, their governance and development is outsourced to the community through the use of governance tokens. Since DeFi protocols exist entirely on the Blockchain in the form of smart contracts, they can be integrated into any front-end application (e.g Compound in Argent, ZenGo and Dharma) permissionlessly . Also because protocols are not companies they can’t offer some specific features involving off-chain contractual obligations, such as fiat on & off-ramps. However, these features can be built on top of these protocols by the aforementioned front-end applications to make it easier for investors to use them.

Examples: Compound, dYdX, Aave, and nüo.

2. Different business models

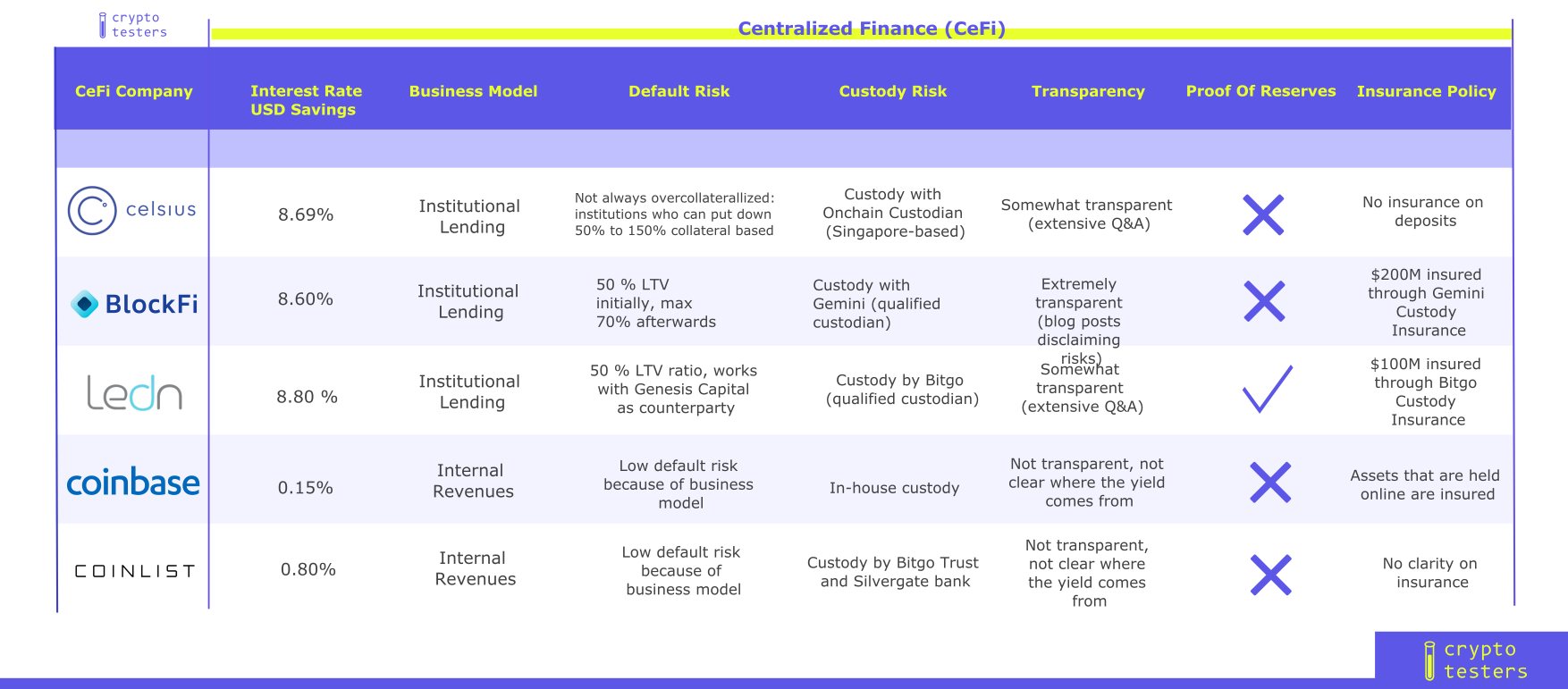

Pointing out the different demand dynamics between DeFi and CeFi is only a part of the explanation. Within CeFi, we have companies like Coinbase offering a mere 0.15% APY on USDC savings, while BlockFi offers a stunning 8.6% APY on their GUSD savings account.

The reason for this stark difference is that BlockFi generates interest on assets held in interest accounts by lending them to institutional and corporate borrowers, while Coinbase is financing this by pulling from pre-existing revenue streams like trading, treasury management, or investment activity.

The question that every investor has to ask themself is whether the offered return is worth the risk. It’s obvious that BlockFi’s business model to achieve the yield is inherently riskier than Coinbase, but the real question is whether it is 57 times more risky? Let’s assume we put $1,000 dollar in a Blockfi account, yielding $86 after one year. To achieve the same return on Coinbase, we’d have to deposit $57,333 in our Coinbase account. Which one is more risky?

Given that custody is one of the biggest risks, which is similar for both companies, one could argue that depositing $1,000 in BlockFi is actually the less risky move here when hunting for yield. We encourage readers to do their own research and read the fine prints. There you will find more info to better assess the risks. For example, BlockFi client funds are structured to be at the top of the capital stack, senior to BlockFi equity and BlockFi employee capital. This means BlockFi’s business and client incentives are aligned and BlockFi would take a loss before any client would.

Which rates are higher DeFi or CeFi?

In theory, arbitrage should drive interest rates between DeFi and CeFi Platforms to converge. If rates to borrow are cheaper in DeFi, investors are going to rush to DeFi to get these cheap rates and lend them on CeFi platforms until both rates are in equilibrium. In practice however, we have seen large differences between the two. Right now, interest rates in the DeFi space are significantly higher than what CeFi platforms offer because some protocols offer users network tokens in addition to the normal interest to incentivize network participation. The more users borrow or lend, the more network tokens they earn. This scheme called “liquidity mining”, has led to unusually high activity and interest rates on those protocols.

Before that, we saw a long period where rates were higher in the CeFi space. Centralized Finance Providers have the general advantage of seeing more demand from big traders and institutional investors because their service is more tailored to what sophisticated traders expect (24/7 support, custom deals, fiat on/off ramps etc.) and automated protocols simply can’t offer.

It will probably take some time until markets become sufficiently efficient for interest rates to fully converge and institutional traders to become comfortable with DeFi. We see first signs of this with CeFi Lenders like Nexo sourcing cheap capital from DeFi protocols when market conditions are favourable or supplying assets when lending rates are high. One reason rates could remain different is that consumers come to a conclusion that one business model is significantly riskier than the other. More on that in the next section.

What are the risks?

Like any financial investment, depositing your assets into a crypto savings account comes with risks regardless of whether it’s CeFi or DeFi.

Risks with Crypto Lenders

Loan Defaults

As we mentioned before, the risk of default on the borrower side is limited because lending platforms use “over-collateralization” to reduce credit risk. If the value of the collateral backing a loan falls under a certain threshold the provider sells of the collateral. However, in the event of a black swan event where the market crashes extremely rapidly and many liquidations happen in the same time, the proceeds of the assets sale could be insufficient to pay back the lender. While this is certainly a possibility it’s important to stress that this has never happened in real-life even when markets crashed 50% on a single day.

Custodian Hack

Probably the largest risk factor is that the lending company’s custody provider (where your assets are stored) gets hacked. If someone penetrates one or multiple of the crypto lender’s wallets containing the collateral, loans wouldn’t be secured anymore and lenders could lose all their deposits. To offset this risk, many custody providers have insurance policies to protect users in case they do get hacked. Unfortunately, these often have a ceiling amount so whether you get reimbursed or not in the case of a hack depends on the size of the hack. Moreover, if the attack affects all the custody provider’s clients (exchanges, institutions, crypto lenders etc.) and not just one, the insurance amount would certainly not cover all the losses. BitGo for instance, one of the most important custody provider’s has a $200m insurance policy in the case of a hack but has x amount of assets under management (AUM).

Intransparency

The crypto lending space is fairly unregulated and it’s almost impossible for lenders to know what happens with their deposits. It’s entirely up to the provider to provide transparency. There are concerns that crypto lenders provide more risky (e.g not sufficiently collateralized) loans to specific clients. Some crypto lenders also rehypothecate some of the collateral their borrowers deposit as security, to earn additional money. This practice was widely used in 2008 and eventually led to the infamous Great Financial Crisis.

Legend:

Insurance policies: Look for providers that have a direct insurance policy, in addition to their custodians’, which protects only their users’ funds.

Proof-of-reserve: Some crypto lenders (Ledn, Unchained Capital) give segregated wallet addresses for each user allowing for real-time checks on-chain and preventing funds from being rehypothecated.

Transparency: Transparent crypto lenders put all the relevant information forward on their site to make it easy for users to find out what matters. This includes contract terms, the providers licenses, where the company is incorporates, insurance policies and other information.

Risks with DeFi protocols

Smart Contract Risk

Smart Contract Risk is the main contributor to counterparty risk in DeFi. While DeFi is often referred to as “trustless”, a user of a DeFi platform must trust the smart contract they are interacting with. A smart contract could be opaque to a user who is not tech savvy, which means a user is trusting the contract code in the same way a user trusts the code of a traditional web application. This could potentially be exploited by malicious smart contract developers although users can protect themselves from this risk by only using protocols which have been audited by the community and professional audit firms. The far bigger risk however, is that the smart contracts get hacked because of a loophole in the code. This happened in February 2020 when DeFi lending protocol BzX lost $645,000 dollars in an attack (all funds were returned by the hacker in the end).

Loan Default

As with centralized crypto lenders, over-collateralization doesn’t completely remove credit risk. For example, during this year’s biggest market crash the Maker protocol lost $4m of collateral because liquidators were able to submit $0 bids for ETH collateral held in users’ vaults. In short, the Maker protocol relies on a system where users/liquidators can submit bids to acquire collateral-at-risk for a small discount relative to the market price. Since this represents a relatively risk-free profit opportunity, these auctions are usually very competitive. However, in this particular case there were no other bids due to unprecedented Ethereum network congestion and liquidator bots not being set up adequately for this scenario. With no other bidders being around one participant was able to buy the collateral for virtually nothing. The problem has since been fixed and the collateral has been refunded after new Maker tokens were issued by the protocol and publicly auctioned (effectively diluting existing MKR holders), but it’s a good example to understand the types of unexpected events that can happen in DeFi.

Another factor to take into consideration, is the type of assets being used as collateral in a protocol and its respective liquidity. Ether (ETH) collateral for instance, is more secure than an illiquid ERC-20 token, which can lose value very rapidly during a market sell-off event. This is why there’s currently a big debate in the Maker community over which types of assets can be added as collateral. Protocol purists would like to keep the protocol simple using only Ether while others want to add new types of assets to attract new investors and increase the addressable market size. In liquidity pool based lending protocols such as Compound it’s easier for a user to assess the riskiness of the collateral, since liquidity pools are segregated by asset type. If you lend ETH to Compound’s ETH pool, you can rest assured that the collateral deposited in the pool by borrowers likewise only consists of ETH.

One way in which DeFi is strictly superior to centralized crypto lenders is that all funds are visible on chain so there’s no risk of users’ collateral being rehypothecated without users knowledge. Since collateral requirements are expressed by code in smart contracts, users also have guarantees that the collateral requirements are set in stone, unlike with crypto lenders, who as we mentioned earlier, may negotiate custom deals with large institutional investors.

Centralization Risk

One of the biggest contributors to centralization risk in DeFi protocols is the use of admin keys. Admin keys allow protocol developers to change different parameters of their smart contract systems like oracles, interest rates and potentially more. Protocol developer’s’ ability to alter these contract parameters allows them to cause financial loss to users either voluntarily or involuntarily if their keys get compromised. There are different measures to mitigate this risk somewhat, such as timelocks and multi-signature wallets, which distribute control to a larger number of people and introduce time delays, allowing users to move their funds out of the protocol before a change takes effect.

Although there’s no one size fits all approach to protocol governance, it’s important that protocols disclose this information in a transparent manner. As Jesse Walden wrote in his article on ‘Progressive Decentralization’ , it’s impossible to expect from younger protocols to start being 100% decentralized from day one. Instead, it’s common for protocol teams to start with a relatively flexible set-up, which allows them to iterate frequently until it reaches product market fit and leaves governance to its community.

Legend:

Code Audits: Trustworthy protocols receive regular code audits by specialized security firms and consequently made available to the public.

Maturity: The longer a protocol has been live on chain without being hacked the more likely it is it’s smart contracts have been thoroughly scrutinized by hackers.

Value Locked: The more value is locked in a protocol the bigger the incentive for hackers to hack it. If users trust a protocol with their money it’s a healthy sign that the protocol is battle-tested.

Governance: Protocols are controlled by Admin Keys that can upgrade smart contracts. Admin keys can be held by a centralized company or by a Governance contract which is controlled collectively by the community, in which case it is referred to as "decentralized".

Conclusion

In this article we pointed out that savings rates differ substantially. First, rates can differ significantly between CeFi and DeFI because of the different supply and demand triggers, and additional incentives in DeFi (“Liquidity mining”) to bootstrap liquidity. Also within CeFi or DeFi, interest rates deviate substantially, depending on the business model or the risks of the protocol.

To help readers put the different interest rates in context, we described the various risks that come with depositing your savings with either decentralized protocols or traditional companies, as well as listed the best practices for each.

The key learnings we took away from this are threefold:

First, when comparing rates of CeFi companies, it is important to ask yourself what the real risks are, and whether the promised return is worth that risk. If you think the main risk lies in custody, then you’d rather deposit small amounts that offer a high return instead of high amounts that offer a lower, yet less risky return since you’ll face the custody risk in both cases. On the other hand, if you think the main risk is inherent to the business model (e.g. companies lending out your money to insolvent counterparties or on an undercollateralized basis), then you’re better off avoiding CeFi lenders altogether.

Second, without a widely accepted approach to on-chain reputation or identity, the only method to avoid unwanted amounts of credit risk in DeFi money market platforms is to use over-collateralization. In terms of transparency, the DeFi space is lightyears ahead of the CeFi space since contract terms are set in stone in the form of code and users can see in real-time how much collateral the protocol holds by looking at the Blockchain. To get a measure of smart contract risk, looking at things like a protocol’s maturity, the amount of collateral it holds or the number of audits it has been through, can be helpful since it shows that the code has been reviewed and is trusted.

Third, while CeFi and DeFi have their own pros and cons, some companies try to create the best of both worlds by implementing DeFi elements (e.g. full transparency) into the ethos of their company. A clear example of this is the proof-of-reserves, which we believe could become a standard in CeFi as these companies will have to compete more and more with DeFi.

Emanuel Coen

about 1 year ago ·

14 min read

Latest Content

August 2021

How to make money selling options with R...

June 2021

Top 5 Crypto Lending Platforms to Watch ...

June 2021

What is Hop and how does it work?

May 2021

What are NFTs: Environmental Nightmare, ...

April 2021

Sam Bankman Fried from FTX on his Master...

April 2021

Stefaan Ponnet Founder of AvadoCloud abo...

April 2021

Alex Salnikov from Rarible.com on NFTs, ...

March 2021

Nate & Mark from Bancor on Building a Ne...

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

How to buy bitcoin

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials